MarineMax made a net loss of $52.1 million for its fiscal 2025 third quarter ended June 30 2025.

The organisation’s revenue for the quarter declined 13.3% to $657.2 million from $757.7, primarily due to lower new boat sales partly offset by stronger used boat sales and growth in many of the company’s higher-margin businesses.

Same-store sales were down 9% compared with the prior year.

Gross profit decreased 17.6% to $199.6 million from $242.1 million in the prior-year period with the gross profit margin of 30.4% down from 32% in the same period in 2024, primarily reflecting lower new boat margins due to the challenged retail environment.

Net loss in the third quarter of fiscal 2025 was $52.1 million.

Economic activity

For the same period of fiscal 2024, MarineMax had a net income of $31.6 million.

Adjusted net income in the third quarter of fiscal 2025 was $11 million, compared with $34.8 million, in the prior-year period.

Adjusted EBITDA for the quarter ended June 30 2025, was $35.5 million, compared with $70.4 million for the comparable period in 2024.

“A combination of ongoing economic uncertainty, evolving trade policies and geopolitical tensions contributed to weak retail demand across the recreational marine industry in the June quarter,” explained Brett McGill, chief executive officer and president of MarineMax.

Challenging conditions

“Business conditions have been challenging throughout the fiscal year, with increasing consumer caution since April, particularly among prospective new boat buyers, many of whom are delaying their purchases until conditions improve.”

However, he said continued diversification efforts have helped offset some of the pressures on new boat margins during the fiscal year, with a 31.8% gross margin through the first nine months of fiscal 2025.

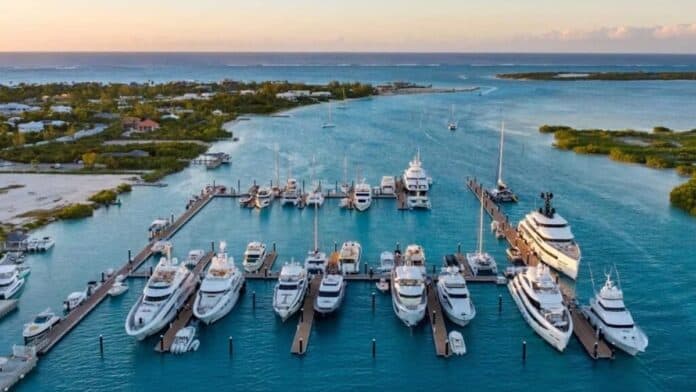

There have also been strong contributions from higher-margin growth areas such as the organisation’s finance and insurance, marinas and superyacht services.

“Although industry inventory levels remain elevated due to softer sales in the June quarter, we expect improvement ahead, with forecasts indicating a gradual rebalancing beginning in the back half of calendar 2025,” added Brett.

Cautious outlook

MarineMax has revised its 2025 fiscal guidance downwards and now expects its adjusted EBITDA to be in the range of $105 million to $120 million, compared with a prior range of $140 million to $170 million.

“While our near-term outlook is cautious due to the ongoing economic uncertainty, we are confident that our overarching strategy will drive operational resilience,” said Brett.

“As the recovery takes hold, we believe our long-term earnings power will be significantly enhanced by our growing presence in higher-margin businesses and by the resilient consumer demand for the boating lifestyle.”

MarineMax has more than 120 locations worldwide, including over 70 dealerships and 65 marina and storage facilities.